A vehicle to scale financing for fisheries in transition: Concept Summary

1. Context

Building on the experiences of World Wildlife Fund (WWF) and Wilderness Markets over the past 5 years, and on the literature in the field, we have made significant progress in the development of a proposed financing vehicle for fisheries improvement. The vehicle is an innovative financing model capable of “blending” capital to scale fisheries improvements in collaboration with the private sector, ensuring industry can directly contribute to the costs of improvements needed to transition fisheries towards sustainability. The proposed vehicle is a fund designed to align and expand the pool of investors in sustainable seafood, provide current philanthropic investors with an exit strategy for direct fishery improvement funding, and ensure strong fishery performance and accountability to strengthen impact.

Despite professed investor interest in ocean-related opportunities, the ocean is one of the least invested in areas of all the UN Sustainable Development Goals (SDG).1 This paradox is particularly true for private capital, where only 21% of impact investors surveyed say they target SDG 14, Life Below Water, through their investments.2 Ocean investing has challenges for both investors and investment developers. Barriers to engagement by institutional investors are due to a lack of investment grade projects, lack of firms at adequate scale insufficient internal expertise, lack of definition, and lack of variety of asset managers.3

Recent analyses highlight the need for new, innovative approaches to financing fisheries conservation to adequately address the environmental, social, and economic needs of the world’s seafood sector.4 These analyses suggest that a “portfolio of strategies to match the complexity and individuality” of the sector are needed, including a focus on capacity building tools, development of innovative financing vehicles, acceptable social and environmental impact metrics, and the ability to connect actors. Other opportunities for finance include rebuilding fish populations, improving fisheries governance systems, establishing seafood traceability, and adding market value to responsibly harvested fisheries products.5

The ’Fisheries Improvement Fund’ addresses these constraints and opportunities. Through extensive engagement with a range of stakeholders, along with an analysis of the financing requirements, the fund is a structured financing model that works with current participants in the fishery improvement space. The design of the fund aims to reduce transaction costs and streamline implementation of fisheries improvements while bringing in new capital providers and defining impact metrics to provide improved accountability to investors and participants. It does not intend to replace the many excellent existing practitioners, but rather to address inefficiencies in the current fisheries improvement model in collaboration with key stakeholders.

2. The Financing Model

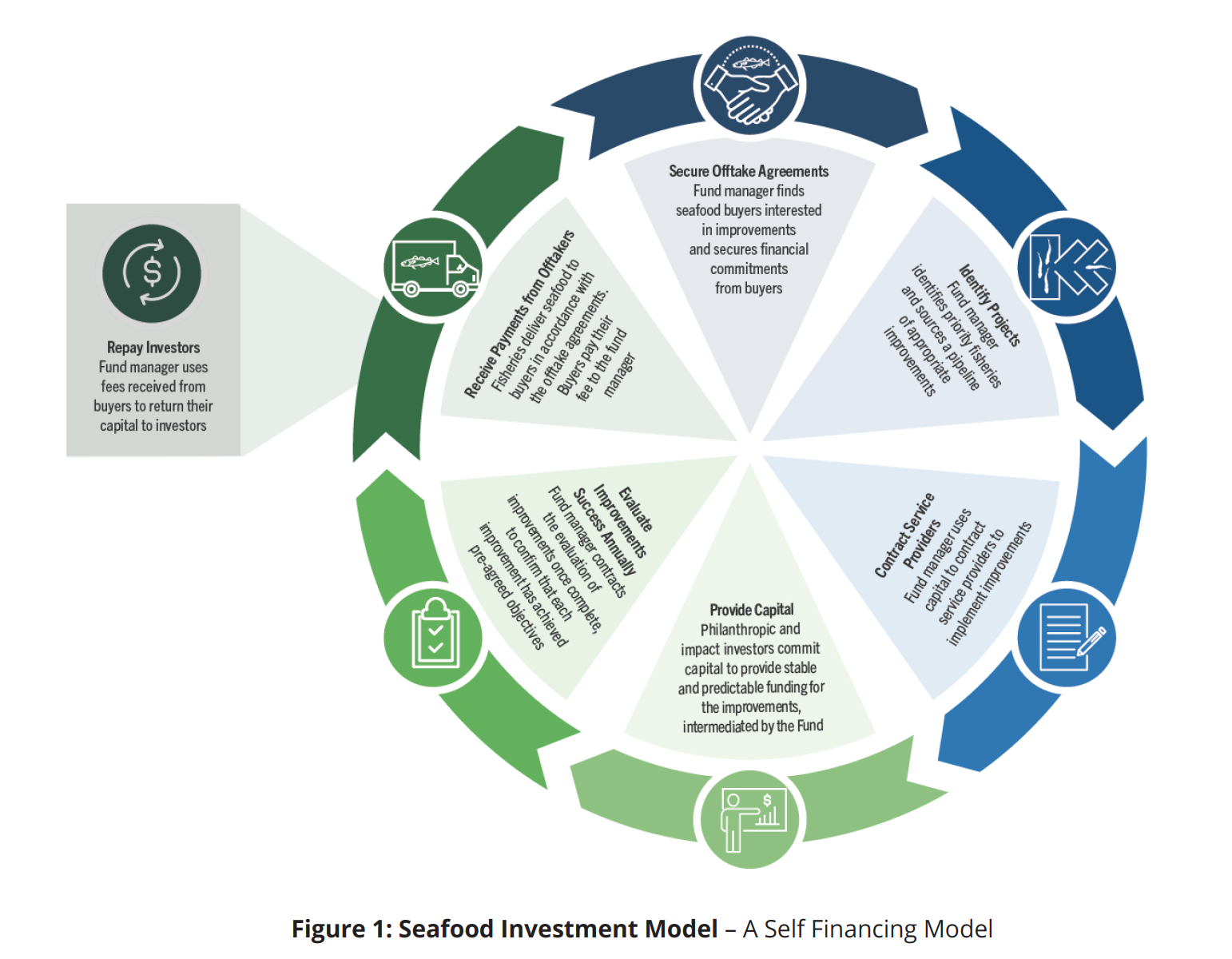

The proposed model is built around a volume- based off-take contribution from industry that enables the fund to secure the necessary upfront investment in fisheries improvements (as depicted in the graphic above). With this commitment, investor funds are raised and deployed to engage ‘Service Providers’6 (e.g., FIP implementers) to deliver agreed fisheries improvement outcomes towards globally benchmarked standards and certification. Industry participants repay the investor funding via their volume-based contribution through the fund. This model builds on existing, successful initiatives, such as the National Fisheries Institute (NFI) Crab Council model and the WWF FIP Participant model in which multiple companies sourcing from FIPs contribute financially through a volume-based contribution to FIP implementation. As such, the Fisheries Improvement Fund builds on this track record of industry participation and incorporates it into a blended, globally scalable finance vehicle. This allows for projects to be more efficiently planned and executed with financial contribution matching fishery improvement workplan implementation. This also reduces transaction and implementation costs allowing funding needed to complete the project within the given timeline as well as incentivizing competition for more efficient, lower cost fishery improvement implementation. Last, this provides a means for investors interested in supporting the sustainable blue economy to participate in fisheries recovery in a way that has up until now not been available to them.

More information on the model is available on request.

3. Key Achievements to Date

Despite the impacts of COVID-19 and the pandemic related disruption, we made significant progress developing the concept feasibility during the past year:

Economics – Proving the conceptual and real-world feasibility of the model

- Development of detailed financial modeling, business plan and investment memorandum

- Engagement of the private sector in the volume-based contribution per pound/metric ton model

- Development of a term sheet with one of the world’s largest tuna brands

- Development of MOUs with US and EU mahi importers

- Engagement and expressed interest from the largest aquaculture feed companies (Cargill, Biomar, Nutreco/ Skretting) on small pelagic fishery improvement through the fund

- Offer to present the concept to SeaBOS for consideration

Investors – Attracting new capital

- Securing design funding from Convergence Finance

- Engagement with the International Finance Corporation (IFC) for support in Peruvian mahi and squid fisheries

- Acceptance as an approved “Blueprint” with the Coalition for Private Investment in Conservation, which shortlists the vehicle for the new IUCN / Mirova Nature+ facility

Impact – Defining eligibility

- Development of proposed social and environmental screening and impact metrics for peer review

Pipeline Development – Identifying and engaging with potential investable projects

- Compilation of 266 fisheries with inputs from industry and NGO partners that we will or have already reviewed. Of these, 27 currently meet a minimum criterion (for the pilot) of over 5,000 MT landings by project participants and potential off-take agreement (OTA) participation. Another 13 of the 266 are in active engagement to determine fit with the model.

- A detailed pipeline report is available on request.

Development and Execution Team – Expertise to develop and execute the fund

- A strong team of experts has defined and evaluated the feasibility of the fund and has a strong track record of collaboration. The team includes seafood markets, finance and fisheries experts from WWF and conservation finance and analysis experts from Wilderness Markets. Please see the Annex for more information on the team.

4. Proposed Next Steps

Work to establish the Fisheries Improvement Fund in 2021 will include finalizing the feasibility stage; launching and testing the model through a pilot project based on the pipeline identified; securing new investor dollars and engaging more corporate partners. Seed funding is required to complete these activities and launch the pilot.

5. Conclusion

A unique opportunity exists to support the development of this proposed fund, designed to address urgent constraints associated with the ability to scale fisheries working to transition towards sustainability. The Fisheries Improvement Fund will provide an innovative financing mechanism capable of “blending” capital in order to finance fisheries improvements in collaboration with the private sector and ensure that companies contribute to the costs of necessary improvements in a cost-effective and transparent manner.

Notes:

2 Impact Investing Asset Owner Trend Report. Phenix Capital. 2019. https://www.phenixcapital.nl/asset-owner-trend-report

3 Investors and the Blue Economy. Written by Dennis Fritsch, Responsible Investor, on behalf of Credit Suisse. 2020. https://www.esg-data.com/blue-economy

4 Fitzgerald et al. “Catalyzing Fisheries Conservation Investment”, Frontiers in Ecology and the Environment 2020

5 Holmes et al, 2014. Towards Investment in Sustainable Fisheries: A Framework for Financing the Transition. International Sustainability Unit and EDF, 2014. https://www.edf.org/sites/default/files/content/ towards-investment-in-sustainable-fisheries.pdf

6 “Service Providers” – A defined term in the financing model, qualified Service Providers will be contractually engaged to ensure Fishery Improvement Projects (FIPs) are effectively and efficiently implemented.