Connecting the Dots: Linking Sustainable Wild Capture Fisheries Initiatives and Impact Investors

Why aren’t we seeing the impact investments in wild-capture fisheries that have been transforming smallholder agriculture like cocoa and coffee?

Why aren’t we seeing the impact investments in wild-capture fisheries that have been transforming smallholder agriculture like cocoa and coffee?

Wilderness Markets, with the support of the David and

Lucile Packard Foundation and the Gordon and Betty

Moore Foundation, undertook a series of fishery value

chain assessments to better understand the opportunities and constraints for private impact capital to flow into wild capture fisheries markets.

Given the investments in developing sustainable fisheries pilots, we expected to identify a range of investment opportunities in each of the fisheries assessed. However, we did not find investment opportunities that could address the suite of challenges associated with improving financial and social outcomes, while also contributing to conservation outcomes, particularly in developing country fisheries.

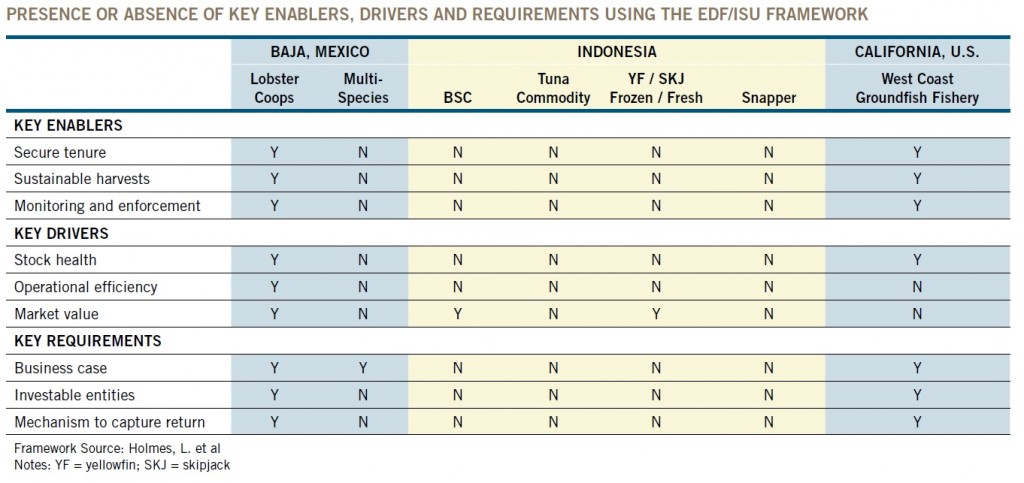

Our research indicates the lack of triple-bottom line (TBL) investment opportunities is due to six main constraints to an economically sustainable fisheries value chain—data, management, market differentiation, infrastructure, finance and the lack of investable entities.

Thus, while there are impact investors interested in these markets, and there are a number of livelihood opportunities for investment, there are few to no entities ready to take on investments that are capable of achieving a TBL outcome similar to examples in the agricultural markets. In reality, investing in the open access, wild capture DCFs for only economic and/or social outcomes is likely to exacerbate and accelerate both the degree and rate of fish extraction.

Looking across the value chains assessed, taking action on solely one point, such as improving data management, has not instigated a cascade of solutions toward sustainability. In fact, the data shows that all six sustainable value chain constraints—data, management, market differentiation, infrastructure, finance, and the lack of investable entities—must be addressed simultaneously to move toward investable, self-sustaining fisheries. Similarly, linking the value chain approach to the EDF/ISU framework allows for a data-driven, market focused approach in selecting, prioritizing and implementing interventions.

Ultimately, developing sustainable seafood value chains means developing a portfolio of solutions. On the assumption that the Key Enablers are being addressed and that secure tenure is part of the solution, there are two kinds of value chain based opportunities appropriate for foundation-type support: the first will inform value chains by providing information about the conditions, opportunities and constraints and is most appropriate for grants; the latter will test and pilot models in seafood value chains that are based on successful innovations in other value chains. The “test and pilot” work is also appropriate for grants and, we anticipate, program-related investment, which could lead to triple bottom line entities attractive to impact investors.

In the end, success hinges on whether the stakeholders are willing to work together and, most of all, put in the hard work needed to address all the constraints.