Markets for Groundfish in California, Part 4 of 4

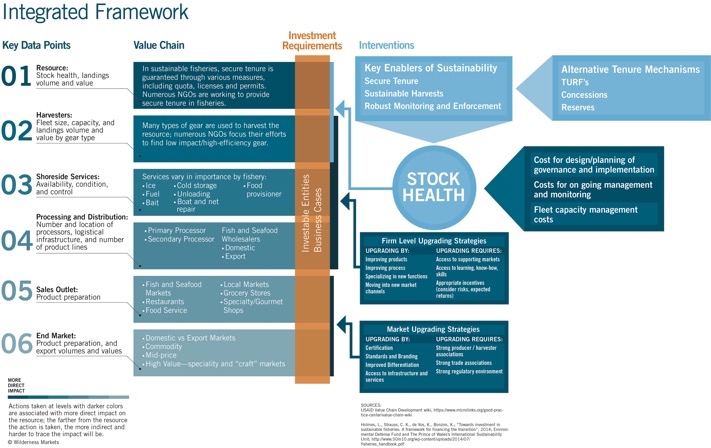

This is part 4 of a 4-part series intended to invite conversations in advance of our planned end market demand analysis for groundfish in California. The larger goal is to provide quantified end market data to inform profitable value chain investments that will positively impact harvesters, local communities and the ocean.

Waste and discards

The opaquest parts of the value chain are the discard and waste streams; we don’t have volume figures to distinguish between discards and processing trimmings and how much of each goes to secondary processors or to landfills. We believe this to be important given the high level of biomass discarded – in some cases as much as 70% of the landed fish (e.g. Dover sole, which has one of the higher quotas).

We identified one secondary processor and were told that disposing of processing byproducts is not a moneymaker; indeed, disposing of trimmings is a cost for processors which may be passed to harvesters. Just how much of a cost is unknown. Also unknown is what proportion is sent to the secondary processor and how much may be destined for landfill. In addition, we don’t know what volume of fish or fish waste enter this stream since the final end-market forms for domestic consumption is unknown (and thus how much fish is processed or sold whole is unknown).

A potential local solution to unvalued fishery byproducts was initiated in Morro Bay in which local farmers picked up bins of fish parts and turned them into soil amendment. However, discovery of state regulations that limit processing of the fish parts prohibited the continuation or expansion of the program.[1]

Questions: Would improving the value of discards and trimmings improve the value realized by harvesters? Is this a viable alternative market?

Final Thoughts

The West Coast Groundfish fishery could be a case study for successful fisheries management for hundreds of other fisheries around the world if it weren’t for the fact that so many harvesters still seem to be struggling economically. Until the harvesters are profitable enough to cover management costs, the most important part of the puzzle isn’t in place. Figuring out where the different pieces fit—value drivers, product flows and the like—will be a boon not only to these harvesters and their communities, but also to parties interested in investing in this, and other, fisheries.

[1] Kathy Johnston, “Hook, Line, and Sinker,” New Times, December 7, 2011, Volume 26, Issue 19 edition, http://www.newtimesslo.com/news/7042/hook-line-and-sinker/.