West Coast Groundfish Pilot: What’s Next for Developing Local Markets?

A previous post outlined the results of the recent market demand research for West Coast groundfish. This post follows-up with more detail on the proposed West Coast groundfish pilot.

Purpose and Intent

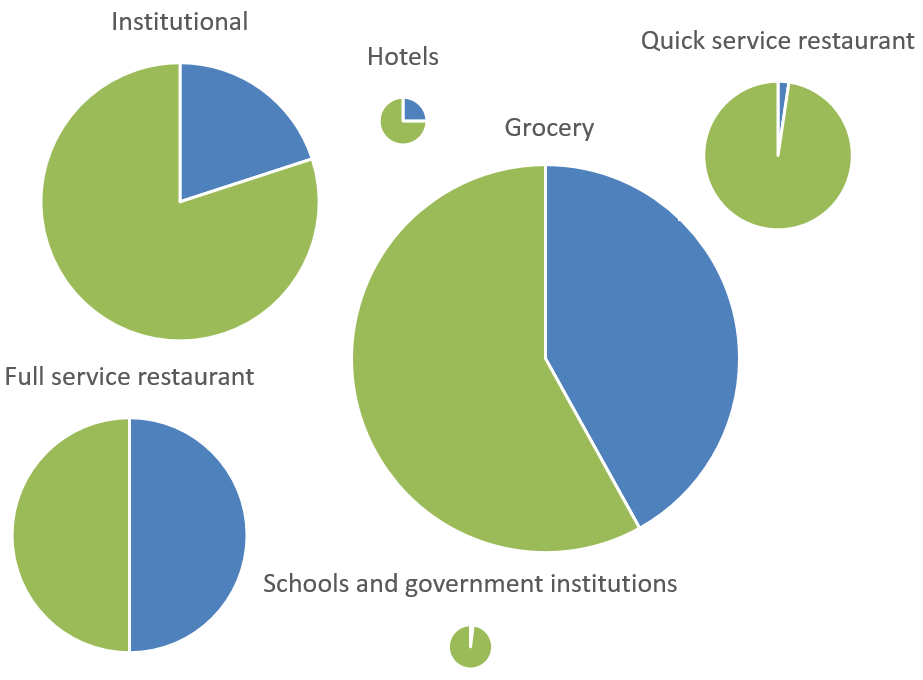

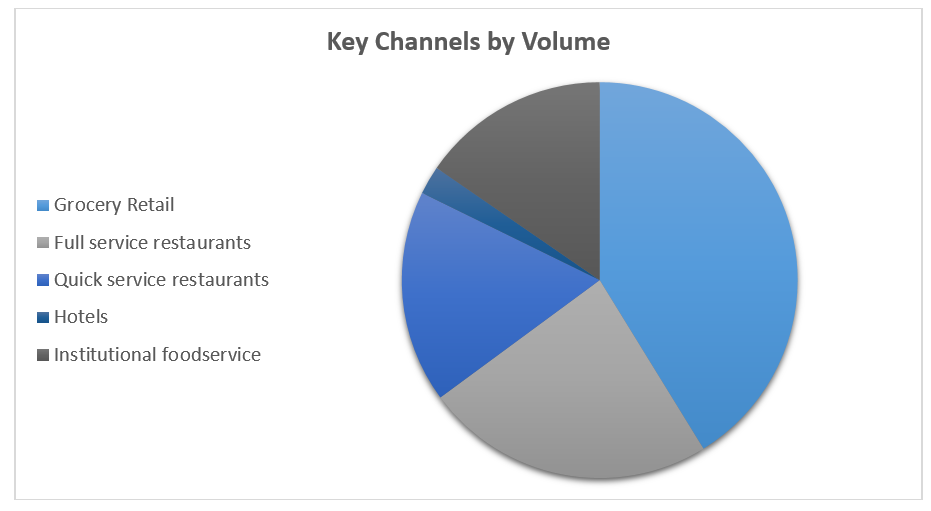

And now what? That was our first question after learning the results from the market demand research. Those results indicated that next efforts to improve demand and pricing for West Coast groundfish should focus on selling minimally processed products to suppliers and buyers in the grocery retail and full service restaurant sectors. The answer is a pilot project; one designed to test the findings which will help U.S. West Coast fishermen expand into regional market.

This project would aim to raise commercial buyers’ and suppliers’ awareness of U.S. West Coast Groundfish as a domestic, sustainable source of whitefish and prove that these fisheries can provide a reliable supply of local fish. As a result, it will establish new markets and demonstrate the benefits and availability of West Coast groundfish to other buyers and suppliers.

Rationale

A pilot project, with defined sales periods and goals, will provide room to experiment to build relationships and to understand the market dynamics. Without a pilot, it will be difficult, if not impossible, to rally collaborative action or justify further investments in the fishery. Harvesters and buyers envision a pilot as being a first step in creating an ongoing sales effort that expands beyond the West Coast within two to three years, possibly sooner.

A successful pilot is key to having larger, sophisticated customers purchase significant quantities for a substantial part of their operations; the pilot also develops the tools they need to successfully use and continue purchasing the fish. Assuming the pilot results in positive values, harvesters, trusts, buyers, NGO’s, and potential investors will have information necessary to make decisions about infrastructure, marketing and other investments. In addition, they can start sizing-up plans in the local, regional and national markets, all of which are important to increasing quota attainment.

Framework

To create organizational capacity that endures beyond the period of the pilot, it needs to be structured carefully. The fishermen and the buyers need to feel comfortable with their roles and build knowledge useful for future efforts. Because of this, the pilot project will endeavor to work within the existing supply chain to build the ability of the harvest groups and processors to provide reliable supply. Memorandums of understanding and contracts for the pilot have to be written so all the parties involved understand their roles and feel comfortable with their responsibilities. Of utmost importance, the pilot design must incorporate a way for the value chain to continue the work after the pilot concludes.

Target Outcomes

Some specific questions the pilot should be designed to answer revolve around the conditions and requirements for supply and pricing. At the outset, stakeholders will need to address legal restrictions on collaboration. The pilot should also define the incentives or conditions needed to gain cooperation between the processors and the groundfish harvesters. Also, the pilot should delineate the amount of fish, prices, and timing (flow of supply and seasons). Finally, the pilot will try to determine the level of transparency needed to build trust so that value chain actors can work together as a team to create value.

Final Thoughts

Regardless of who carries out the work, a pilot is the best next step for the West Coast groundfish stakeholders. The ultimate goals are easy – improve profits for those paying for management – but the route has to be carefully plotted. Building trust and knowledge and demonstrating improved values are key. We can get there, but we have to keep the focus on the end goal of a sustainable fishery, which means ensuring profitability for the harvesters.